Which MedTech sectors see the most oppositions at the EPO? Which MedTech patents are safer from being revoked or limited via EPO opposition?

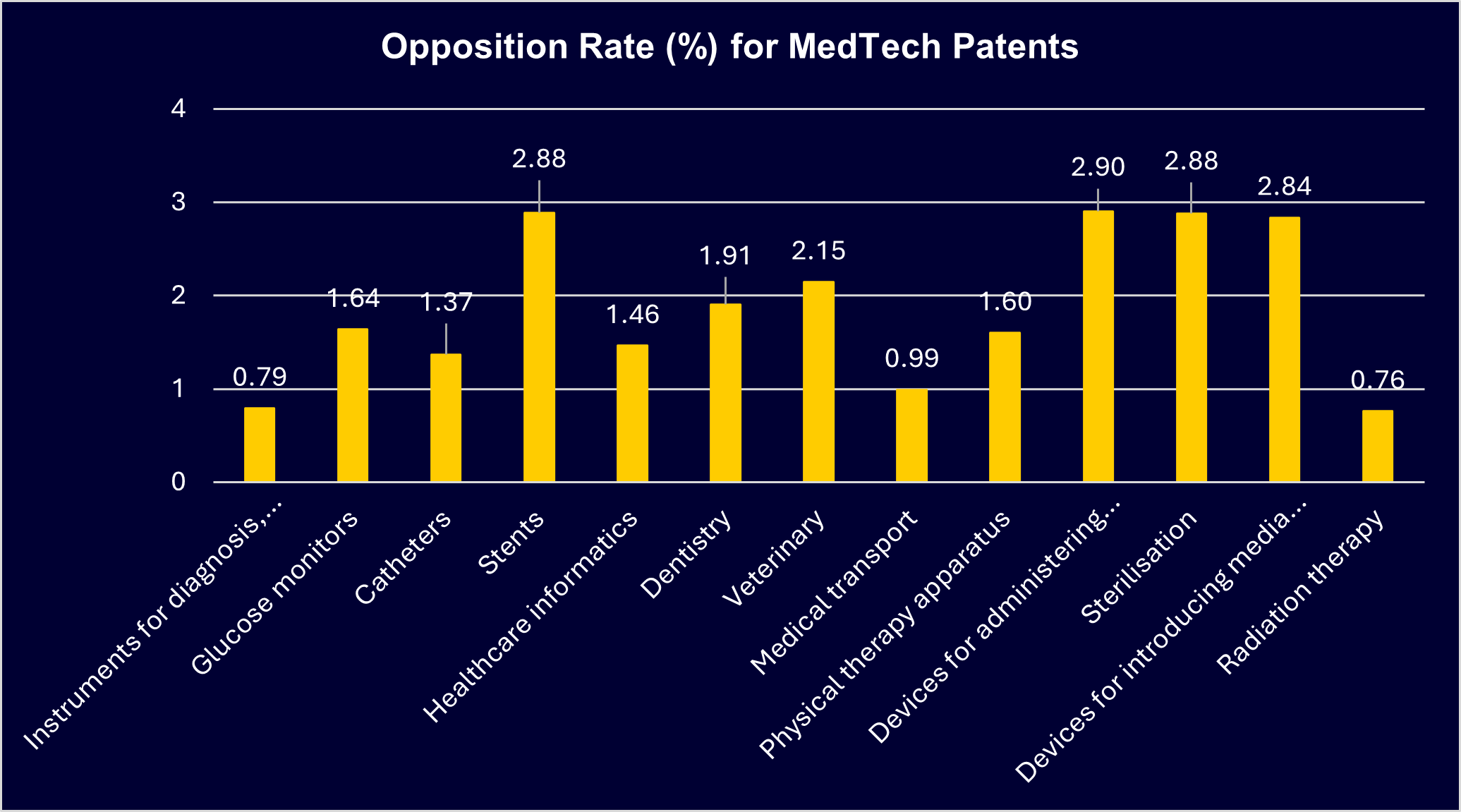

This graph shows the percentage of granted patents which are opposed for MedTech in certain classes*.

We looked at 13 different MedTech categories. The average opposition rate across all these categories is around 1.9%. In other words, on average, for every 100 MedTech patents that are granted by the EPO, 1.9 of them are opposed. However, the data reveals significant variation:

-

The highest opposition rates (approximately 2.9%) appear in those classes which relate to devices for administering medicaments, stents, and sterilisation;

-

Veterinary and dentistry cases are opposed at around, or slightly above, the average rate (approx. 1.9%-2.2%);

-

Patents relating to glucose monitors, physical therapy apparatus, and catheters are opposed less often than average (approx. 1.4-1.6%); and

-

The lowest opposition rates (below 1%) occur for patents in the fields of medical transport, instruments for diagnostics/surgery/identification, and radiation therapy.

This data is provided primarily as food for thought, though companies may wish to consider the opposition rate in their sector and consider if it should impact their patent strategy, or whether this stat may be useful when communicating and discussing patent strategy within the company.

Why the high rates?

The data suggests that certain MedTech categories face considerably more challenges from competitors than others, with patents relating to devices for administering medicaments experiencing nearly four times the opposition rate of radiation therapy patents.

The sectors incurring the highest opposition rates make sense. Patents relating to devices which (for example) administer medicaments or which provide sterilisation often represent high-revenue, high-margin products in the healthcare industry, and technological advancements continue to fuel growth in these sectors. For example, the global auto-injector devices market is growing significantly and projected to reach £3.02 billion in 2030.1 The global sterilisation market, valued at $15.7 billion in 2023, is forecasted to grow to $24.7 billion by 2029.2 Competitors therefore have strong incentives to challenge patents that might impede their entry into the market, or which would otherwise cut into future profits by requiring the payment of licencing fees.

In addition, such devices are likely to be highly regulated and may have fewer overall design options available. In these fields, designing around a competitor patent becomes difficult or even impossible, and companies may be required to “clear the way” via litigation actions and/or an EPO opposition to move forward with a new product launch.

How does this relate to patent strategy?

A high opposition rate suggests a litigious field, having a higher risk of infringement proceedings. Companies operating in these areas should ensure that a comprehensive risk management strategy is in place, and decide how offensive or defensive that strategy is.

For companies in competitive areas, risk management should not stop at one-off risk mitigation and ‘freedom-to-operate’ projects as new products are brought to market. These companies should have a process for monitoring competitor patents on an ongoing basis to identify risks to current and future products. If risks are identified, many options are available, with oppositions being a useful tool in Europe as part of an offensive strategy for clearing the way and providing an early, cost-effective way to challenge validity before resorting to more costly litigation such as a UPC action.

As well as considering the risk posed by competitor patents, part of a successful risk management strategy should entail strengthening your own patent portfolio. Companies should ensure that patents are not only a defensive asset creating deterrence by protecting the company’s products, but are also creating leverage via their relevance to future avenues of research and development for competitors and the market more generally.

Of course, while low opposition rates may be indicative of a less litigious environment, no field is free from post-grant challenges. Contact our dedicated medical technology and oppositions teams to discuss how we can help you navigate the opposition landscape specific to your technology.

*We’ve focussed on patents having a priority date from June 2014 onwards.

1 https://www.marketsandmarkets.com/Market-Reports/autoinjector-market-173991724.html?gad_source=1&gclid=Cj0KCQjwhr6_BhD4ARIsAH1YdjAGUUC8EL0Mbx7vxe2vU5iPKDRWe6IR5cKX1PwdvNA4aJqWD9IzxDEaAoFeEALw_wcB

2 https://www.marketsandmarkets.com/Market-Reports/sterilization-equipment-services-market-642.html?utm_source=chatgpt.comI’ve