The UK and European life sciences sectors have undergone significant shifts over the past two years, reflecting not just the natural volatility of this high-risk, high-reward industry, but also the changing priorities of the investors who fund it.

In this article, we examine the key funding trends across 2023, 2024, and the first half of 2025, analysing the forces behind investor caution, the concentration of capital in fewer but larger deals, and the continued weakness in public markets. We also explore how this selective funding climate has heightened the importance of asset quality and, critically, how investors are using intellectual property (IP) due diligence as a primary tool to assess commercial viability and long-term defensibility.

In an environment where funding is available but increasingly targeted, the strength and clarity of a company’s IP position can be the difference between securing a multi-million-pound funding round and stalling in the capital-raising process. Understanding this connection between market dynamics and IP strategy is now essential for both investors and life sciences companies navigating the shifting landscape.

2023: A year of retrenchment

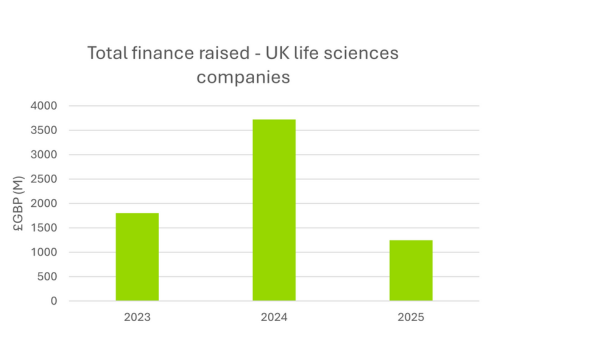

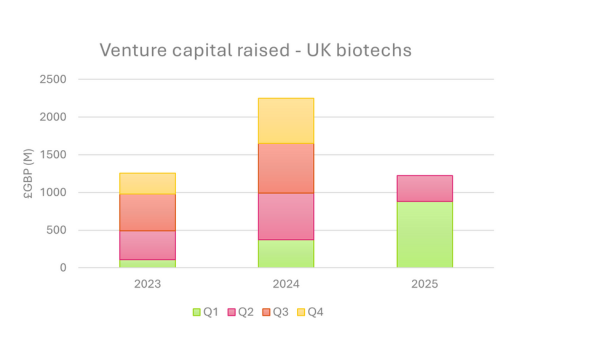

In 2023, life sciences investment patterns shifted towards a more selective and strategic approach, following more widespread investment in previous years driven partly by the attention created by the COVID-19 pandemic. UK life sciences companies secured £1.8 billion in funding (£1.2 billion of which came from venture funding)1, while European peers attracted £8.5 billion in funding2 (comprising £3.4 billion in venture capital3). Although public markets were quieter, with no life sciences IPOs in the UK or mainland Europe, private capital continued to play a pivotal role in supporting innovation. For context, the corresponding figures in the febrile investment environment of 2021, when the pandemic shone a spotlight on the life sciences sector, were £4.5 billion raised by UK companies ( £2.5 billion of venture capital funding) and £6.7 billion raised by European companies4 (~£5 billion of venture capital funding), with £3.3 billion raised in European IPOs5.

As might be expected, investor priorities evolved, with a stronger emphasis on asset quality, clear commercial potential, and structured due diligence. Funding processes became more measured, encouraging companies to refine operations, optimise development plans, and explore a wider mix of financing options. This recalibration set the stage for well-positioned companies to stand out and attract committed, long-term investment.

2024: A measured rebound

The mood shifted in 2024. UK life sciences companies raised £3.7 billion (with £2.3 billion from venture capital) marking a 106% increase on 2023 and the highest total since the record £4.5 billion in 20216. Meanwhile, European life sciences companies raised £5.7 billion (with £4.5 billion raised in venture capital7). Much of this growth came from large venture rounds and follow-on financings, often led by North American investors.

However, this resurgence was concentrated in companies with mature pipelines and robust development strategies. While capital was flowing again, it was doing so selectively, rewarding companies perceived as lower risk and strategically positioned for commercial success.

2025: Strong start, selective momentum

The first half of 2025 has been promising for the UK. Venture capital investment reached £1.23 billion by mid-year, putting the sector on track to match 2024’s £2.3 billion total8. Q2 saw a sharp decline to £344 million from £881 million in Q1, but this was largely due to the exceptional scale of two Q1 megadeals: Isomorphic Labs (£449 million) and Verdiva Bio (£327 million). Deal volumes held steady quarter-on-quarter, and notable raises by Draig Therapeutics and CellCentric underscored the sector’s ability to attract significant funding.

Public markets, by contrast, remain subdued. Only £16 million was raised in follow-on funding by publicly listed UK life sciences companies in Q2, compared with £1.4 billion in 2024. Globally, venture funding softened in Q2: Europe fell 40% to £1.23 billion, while the US declined 24% to £3.96 billion. The UK remained the largest European market, accounting for 28% of the total raised. For European life sciences companies, geopolitical uncertainty, market disruption, and trade barriers are thought to have contributed to a 64% year-on-year funding decline in Q1 2025 compared to 20249.

Financing verdict: Capital is flowing, but selectively

The current environment highlights a defining trend: funding is available, but increasingly conditional on demonstrable value. Investors are prioritising assets that are de-risked, well-managed, and strategically protected.

In this context, strong intellectual property portfolios and clearly articulated development strategies have become critical differentiators. Companies able to demonstrate both scientific strength and commercial defensibility are best placed to secure capital in an environment where investors are choosing quality over quantity.

The central role of IP due diligence in life sciences investment

As life sciences companies compete for funding, investors are making IP due diligence an even more central part of decision-making. Long gone are the days where a simple check was made that patents exist. Reviews now probe the clarity and scope of patent claims, potential third party challenges that could be made to the validity of claims, ownership and licensing arrangements, freedom to operate (FTO) in key markets, potential for follow-on filings, and alignment between patent life and regulatory timelines. A robust IP review gives a deeper picture of commercial viability and risk, pinpointing both opportunities for value creation and red flags that could affect development, market launch, or valuation.

IP diligence is not just a box-ticking exercise - it is a strategic springboard. Many companies use the process to strengthen their portfolios by adding fallbacks to address potential challenges and new patent applications, closing territorial gaps, resolving inventorship issues, and pursuing strategic filings. With funding often tied to clinical milestones, a phased IP strategy aligned to development stages can smooth future fundraising and growth.

These considerations apply to companies at all stages. Early-stage ventures face increasing scrutiny over whether their core innovations are well-protected and scalable. Later-stage companies must also navigate complex factors like patent scheduling, data exclusivity, supplementary protection certificates, and the risk of generic or biosimilar entry, critical to revenue forecasts and investor appeal.

Global scope and investor expectations

With international capital flowing into UK life sciences, due diligence now spans multiple jurisdictions. Companies must demonstrate protection and FTO not only in home markets but also in the US, Europe, and Asia, while factoring in evolving frameworks such as the Unified Patent Court (UPC). For more information on the UPC, see here.

The message from recent investment trends is clear: scientific promise is not enough. Investors demand strong legal and commercial foundations. IP due diligence shows whether a company understands its risks, actively manages its assets, and can deliver on development and commercialisation goals. At Kilburn & Strode, our dedicated teams for risk and opportunity analysis (due diligence) and risk management (UPC and opposition) deliver our high-value and outcome-focused IP offering. With more than 50 technically qualified patent attorneys and a wealth of experience in navigating strategic and contentious IP matters, we provide astute IP analysis to support your commercial decision making and help instigate appropriate risk management strategies. We are internationally recognised for advising on some of the most valuable IP portfolios in the world and for our success in UK and European IP disputes.

Conclusion

Innovation continues to attract investment, but only when paired with legal clarity, asset quality, and strategic foresight. In today’s competitive environment, IP due diligence is a defining capability that shapes perception, mitigates risk, and enables long-term value creation. Life sciences companies that take a proactive, structured approach will be best positioned to secure capital, withstand market volatility, and bring new therapies to market with confidence. Investors that de-risk their investments with comprehensive IP due diligence will find themselves best placed to get the high levels of returns that life sciences companies can generate.

At Kilburn & Strode, our comprehensive IP due diligence offering is twofold, giving: (i) life sciences companies the best chance to secure investment by clearly showing off their robust IP portfolios; and (ii) absolute clarity to investors when looking to invest in life sciences companies and their assets.

For more information or if you have any questions about our IP due diligence offering, please contact Nick Lee, Jake Rightmyer or your usual Kilburn & Strode Advisor.