It is well known that our current global dependence on fossil fuels is unsustainable and that alternative clean sources of energy are needed. Hydrogen in particular is a promising clean energy source. The European Patent Office (EPO) and the International Energy Agency (IEA) have released a report titled Hydrogen patents for a clean energy future which reviews trends in hydrogen patenting in three key categories: hydrogen production; hydrogen storage, distribution and transformation; and the end-use applications of hydrogen.

In this article, we track progress in hydrogen innovation by reviewing trends in patenting across these three categories. We also focus on the geographical origin of hydrogen patenting to provide insight on the location of dominant hydrogen innovation centres.

Hydrogen Production

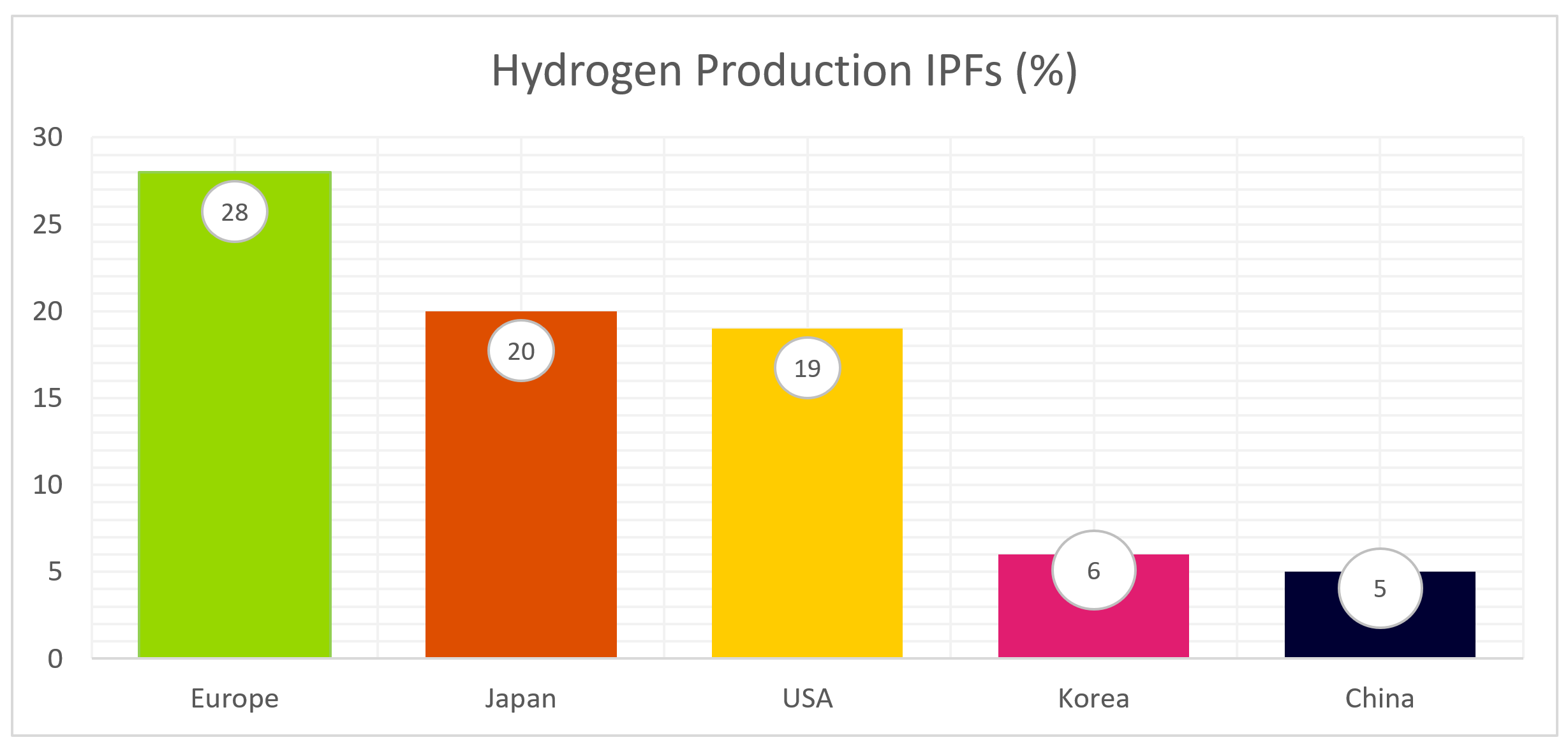

The EPO and IEA study has revealed that, from 2011 to 2020, 28% of all international patent families (IPFs) related to hydrogen production have originated from Europe, with this being the largest contribution of all the territories studied. A large number of IPFs also originated from Japan and the USA, with IPF shares of 20% and 19% respectively. A significant proportion of IPFs also came from Korea and China, with IPF shares of 6% and 5% respectively. These therefore all appear to be important innovation centres for new hydrogen production technologies.

Figure 1: Percentage share of hydrogen production IPFs in Europe, Japan, the USA, Korea and China. Data obtained from the EPO and IEA report: Hydrogen patents for a clean energy future, EPO and IEA, 2023, pages 10 and 28.

Hydrogen production is currently dominated by methods such as steam methane reforming, where methane is reacted with steam under high pressure conditions in the presence of a catalyst, but this produces significant quantities of carbon monoxide and carbon dioxide as by-products. Promisingly, the EPO and IEA report has indicated that there has been growth in the patenting of alternative methods of hydrogen production, with almost 80% of hydrogen production IPFs in 2020 directed to climate-friendly methods of hydrogen production [Hydrogen patents for a clean energy future, EPO and IEA, 2023, pages 13 and 25].

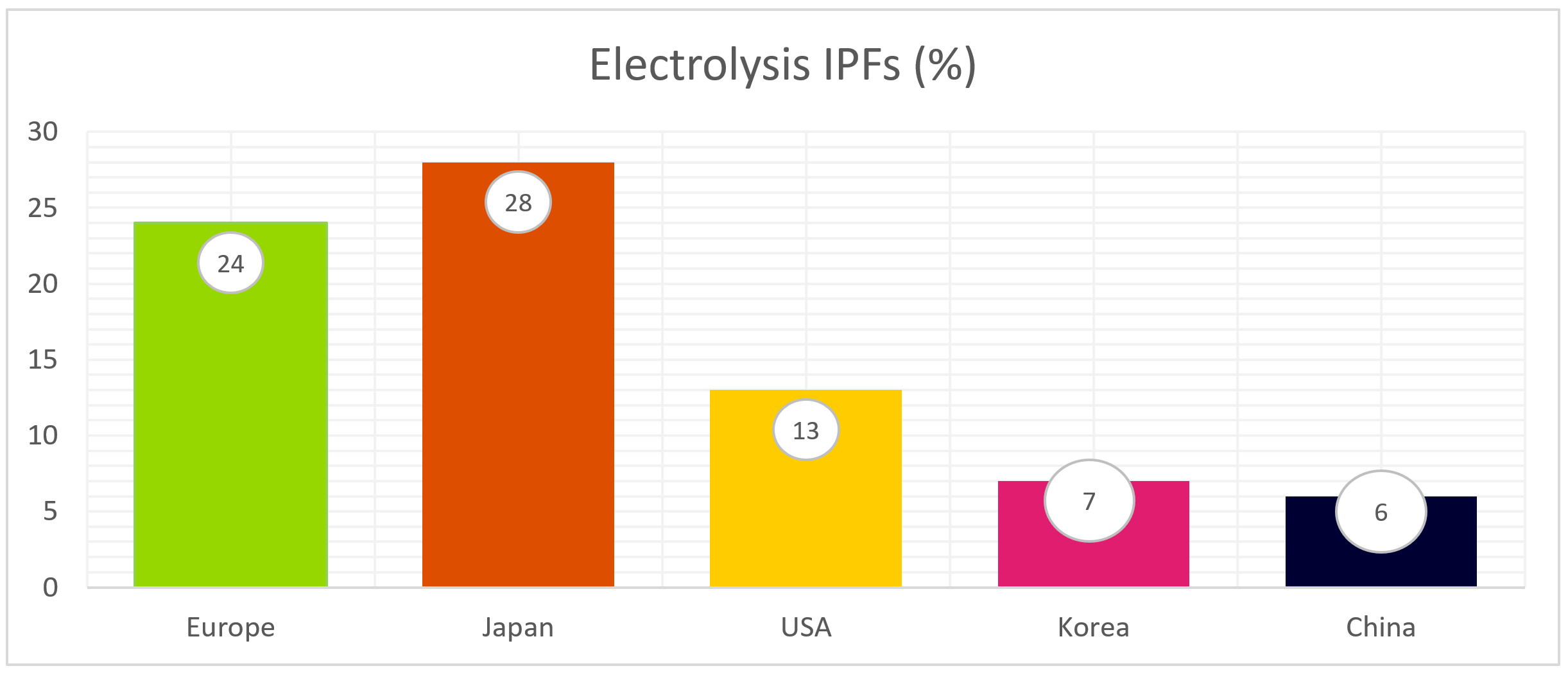

One particularly promising area of hydrogen production that has seen significant growth in the last 20 years is electrolysis. Here, electricity is used to split water into its elemental components: hydrogen and oxygen. The EPO and IEA report has revealed that, from 2011 to 2020, 28% of all electrolysis IPFs originated from Japan, indicating this is an important centre for innovation in this field. Europe is also a key player in this field with a 24% share, with the USA, Korea and China contributing smaller shares of 13%, 7% and 6% respectively.

Figure 2: Percentage share of hydrogen electrolysis IPFs in Europe, Japan, the USA, Korea and China. Data obtained from the EPO and IEA report: Hydrogen patents for a clean energy future, EPO and IEA, 2023, page 40.

Hydrogen Storage, Distribution and Transformation

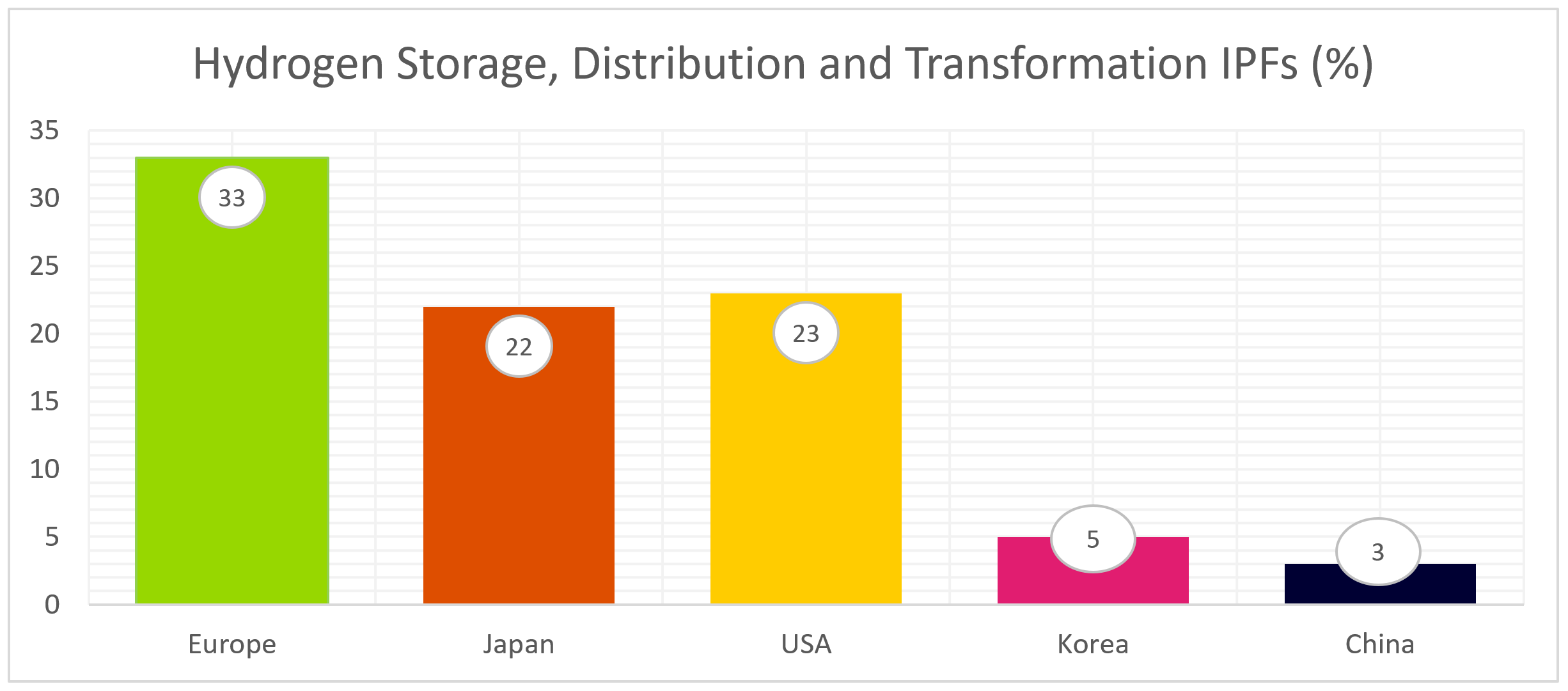

Europe is also the leading region for patenting technology related to the storage, distribution and transformation of hydrogen, with an overall 33% share in IPFs in this field. Again, the USA and Japan are important contributors with a 23% and 22% share in IPFs, with Korea and China contributing smaller shares of 5% and 3% respectively.

Figure 3: Percentage share of hydrogen storage, distribution and transformation IPFs in Europe, Japan, the USA, Korea and China. Data obtained from the EPO and IEA report: Hydrogen patents for a clean energy future, EPO and IEA, 2023, pages 10 and 28.

Europe taking the lead here may be due to European chemical companies already having technology in place for the storage, distribution and transformation of hydrogen produced from fossil fuels (e.g. via steam methane reforming).

Japan and the USA also have a high share of IPFs in this category. Europe, Japan and the USA are therefore all important innovation centres for technology related to distributing and transporting hydrogen.

Hydrogen End-Use Applications

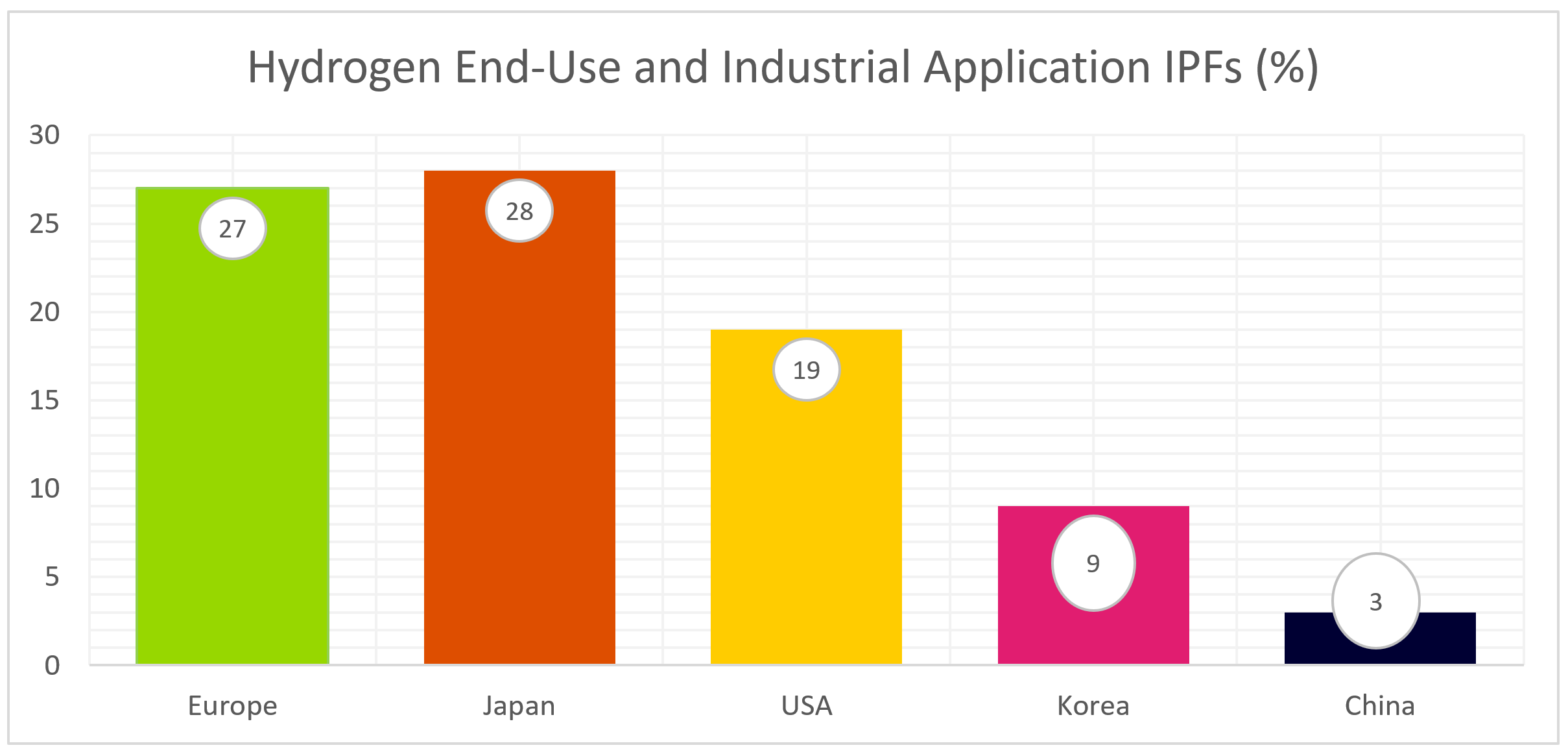

The majority of patents directed towards the end-use and industrial applications of hydrogen have come from Japan and Europe, with shares in IPFs of 28% and 27% respectively. Again, the USA is also an important region to consider with a 19% share in IPFs in this category.

Figure 4: Percentage share of end-use and industrial application IPFs in Europe, Japan, the USA, Korea and China. Data obtained from the EPO and IEA report: Hydrogen patents for a clean energy future, EPO and IEA, 2023, pages 10 and 28.

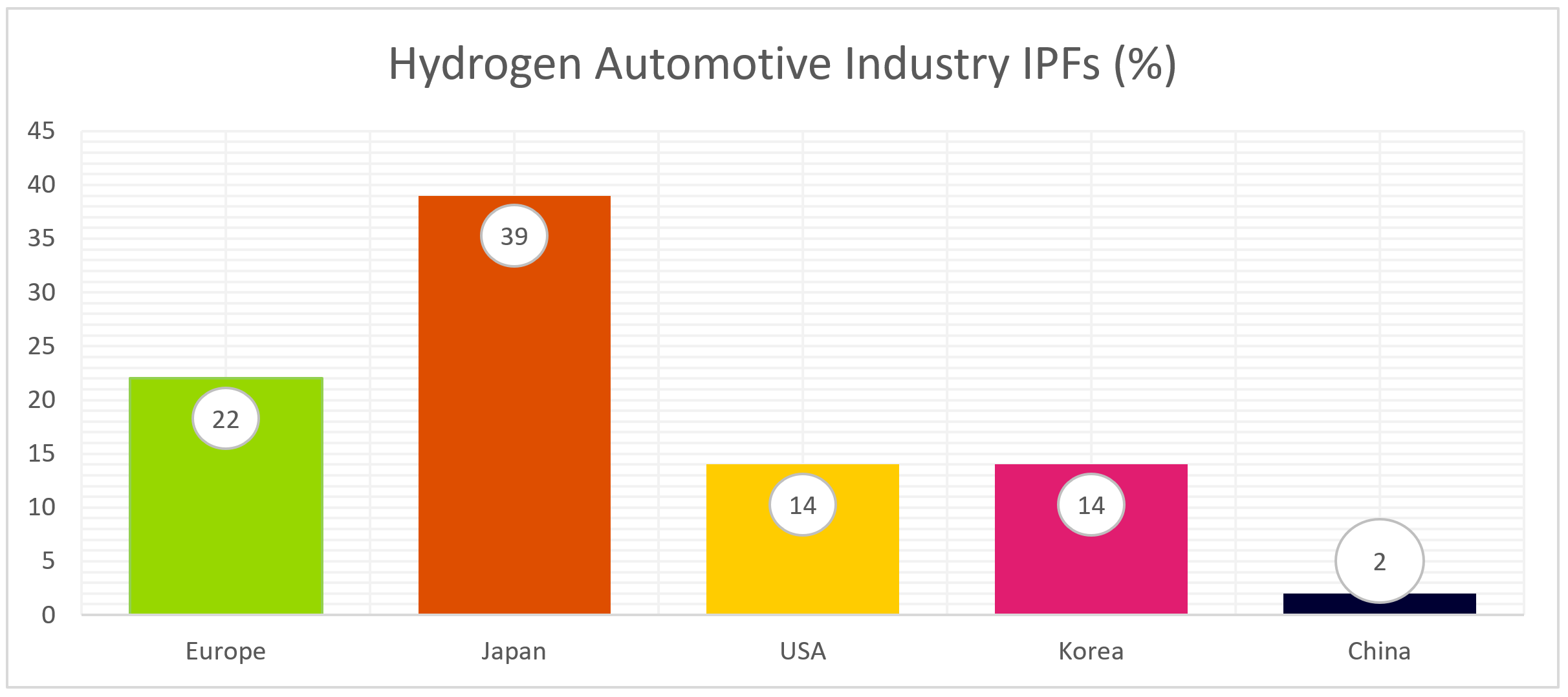

One of the most common end-use applications of hydrogen is as a fuel (e.g. in automotive applications). Taking a closer look at hydrogen patenting in the automotive industry, it appears that Japan in particular is the leading region for patenting in this field, with a 39% share of related IPFs, followed by Europe at 22%. Korea again has a particularly high contribution in this sector, with its contribution matching that of the USA at 14%. Therefore, Korea and Japan are important innovation centres for the end-use applications of hydrogen in the automotive industry.

Figure 5: Percentage share of hydrogen automotive industry IPFs in Europe, Japan, the USA, Korea and China. Data obtained from the EPO and IEA report: Hydrogen patents for a clean energy future, EPO and IEA, 2023, page 63.

Summary and Outlook

Europe, Japan, the USA, Korea, and China have all demonstrated themselves as important innovation centres for hydrogen technology, with Europe, Japan and the USA in particular leading patenting across all three categories of hydrogen innovation. It is therefore important to consider these innovation centres when planning filing strategies.

We look forward to watching the progress of hydrogen innovation over the coming years. With continued progress, we hope that hydrogen will become a viable source of clean energy in the future.

If you would like to discuss this further, please get in touch with Alice Bumstead, James Snaith or your usual Kilburn & Strode advisor.